Premier Heritage Assurance

We understand that each person strive for future financial stability, including building a sound and lasting legacy. But life is full of surprises. Start protecting your future, today.

Preparing a Lasting Legacy

Having Sufficient Retirement Funds

With traditional life insurance solution, Premier Heritage Assurance, ensure your peace of mind today, in the future, and for generations to come.

Insurance Benefit

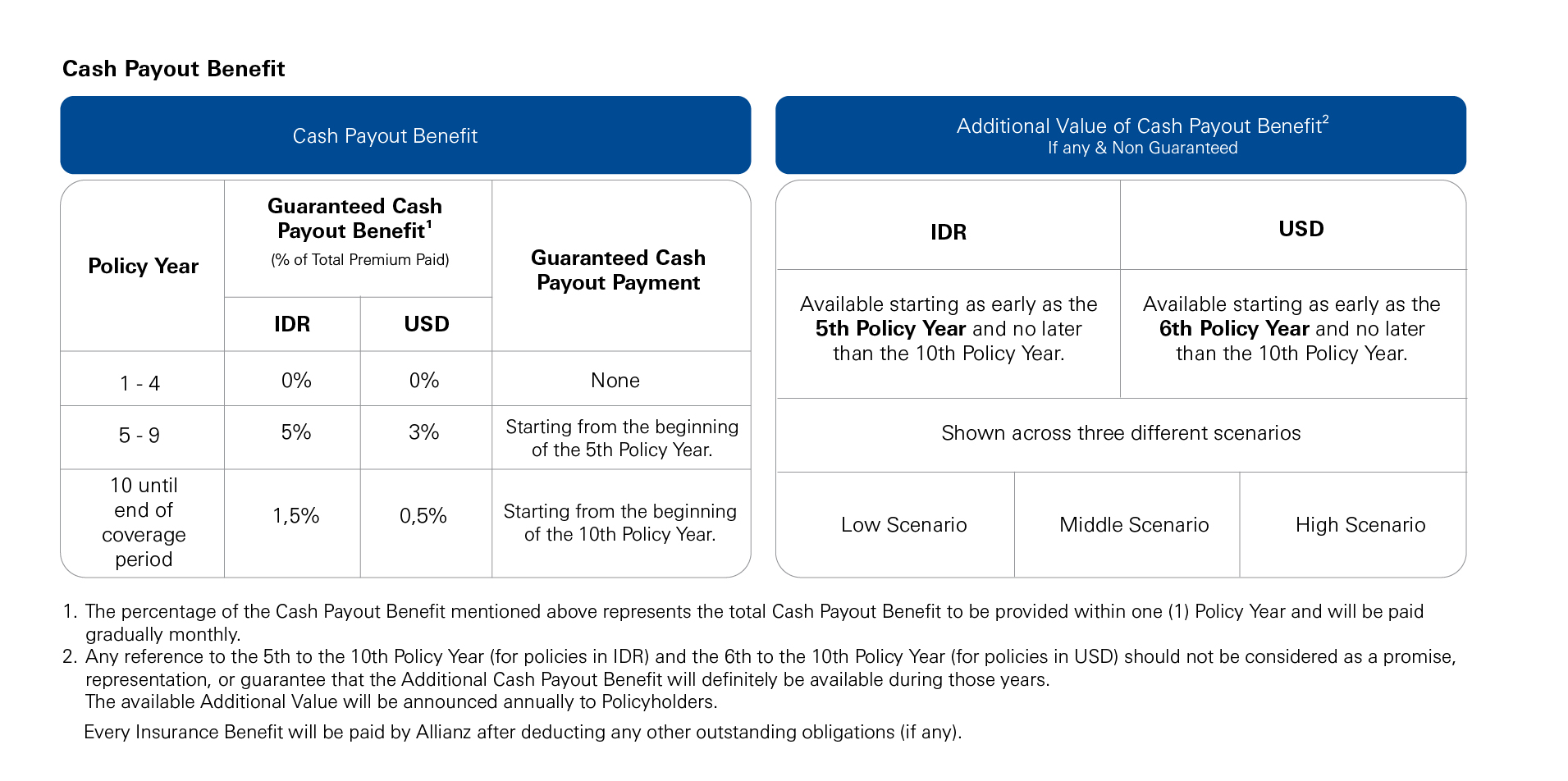

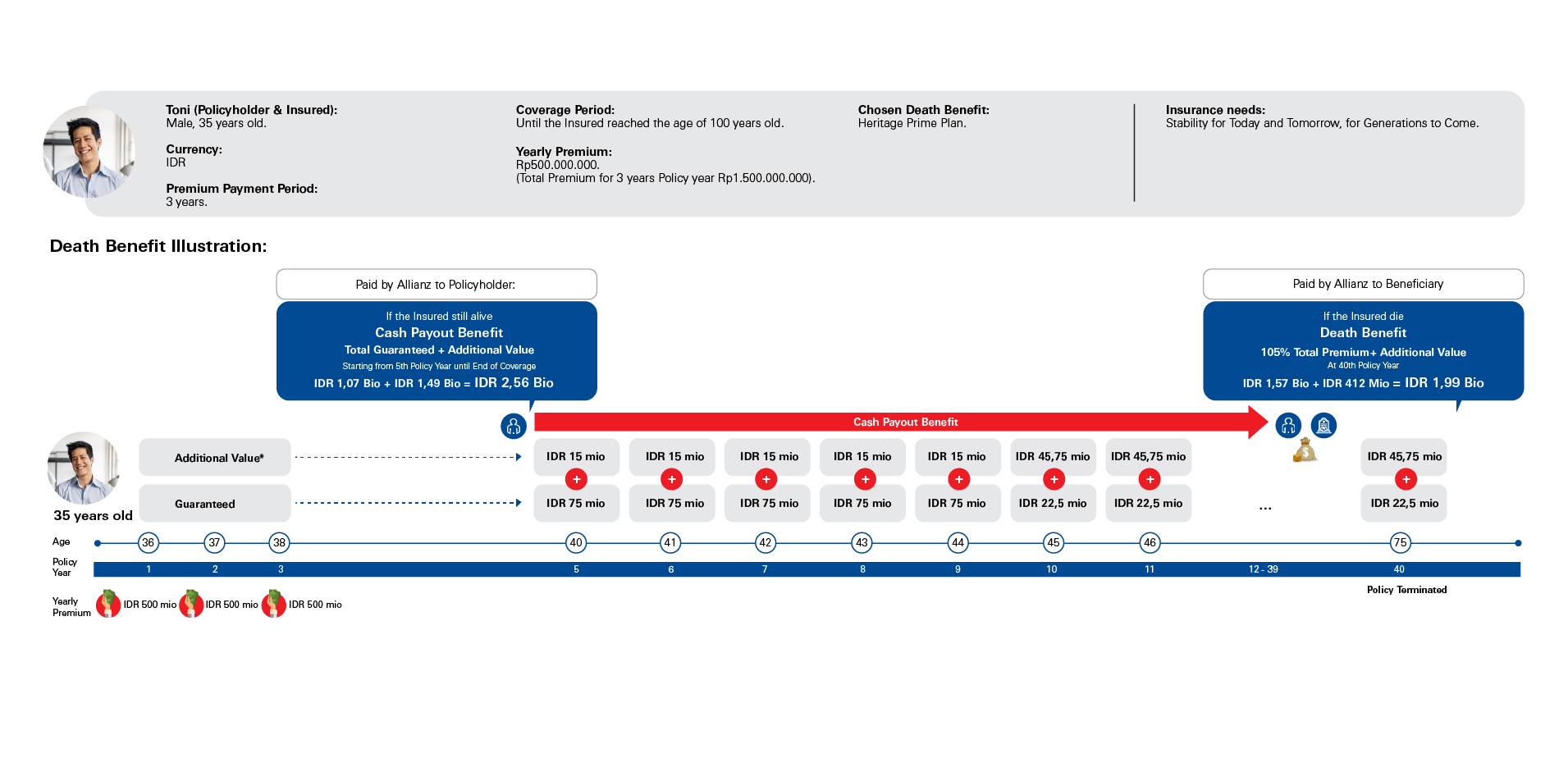

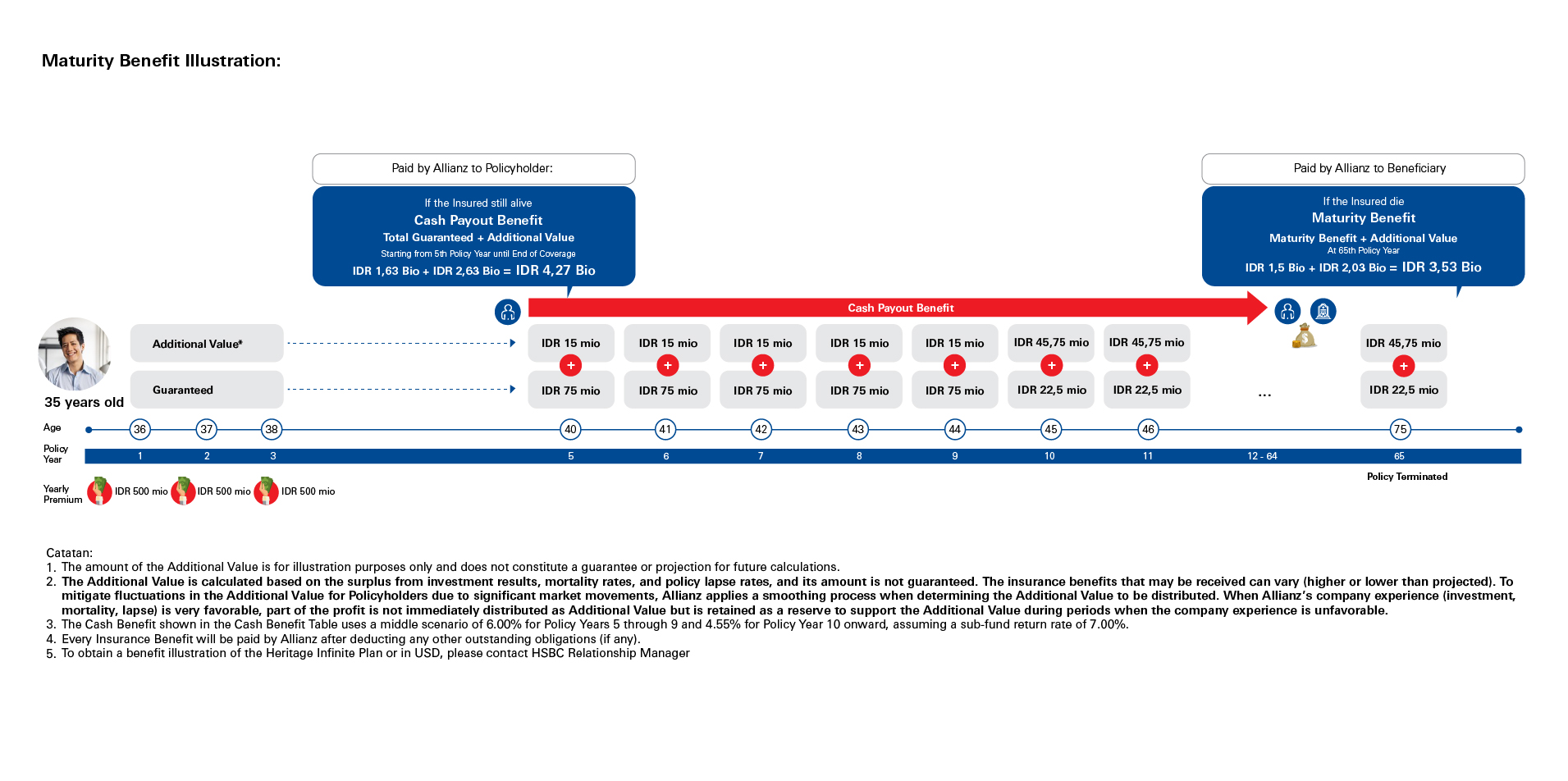

A Cash Payout Benefit, which Allianz will pay monthly to the Policyholder or Beneficiary(1), starting from the beginning of the 5th Policy Year.

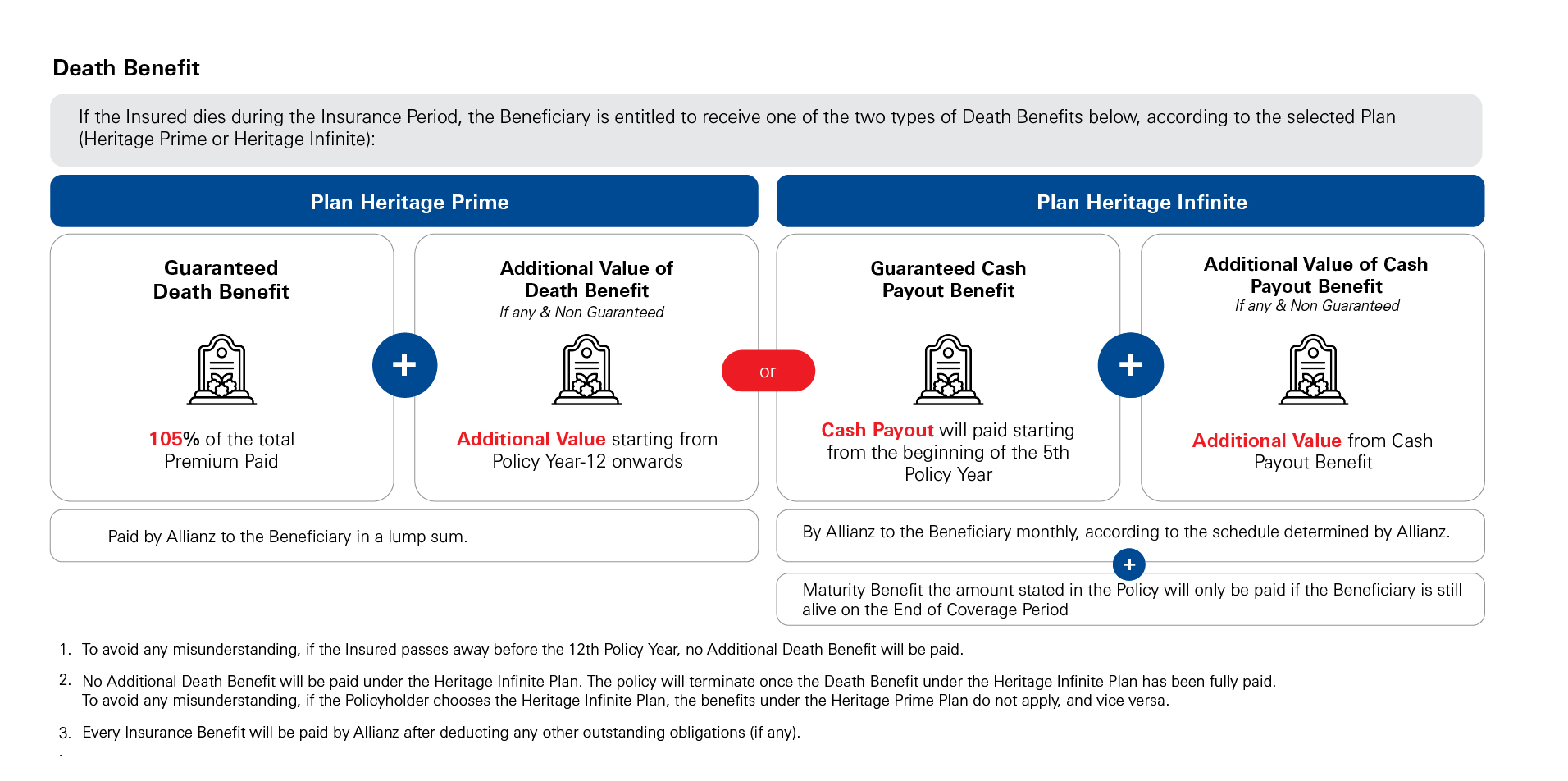

Death Benefit of 105% of the total premiums paid, plus Additional Value that begins to accumulate starting from Policy Year 12.

Flexibility in the choice of Death Benefit that the Beneficiary is entitled to receive, choosing one of two types of Death Benefits according to the selected Plan(2) (Heritage Prime or Heritage Infinite)

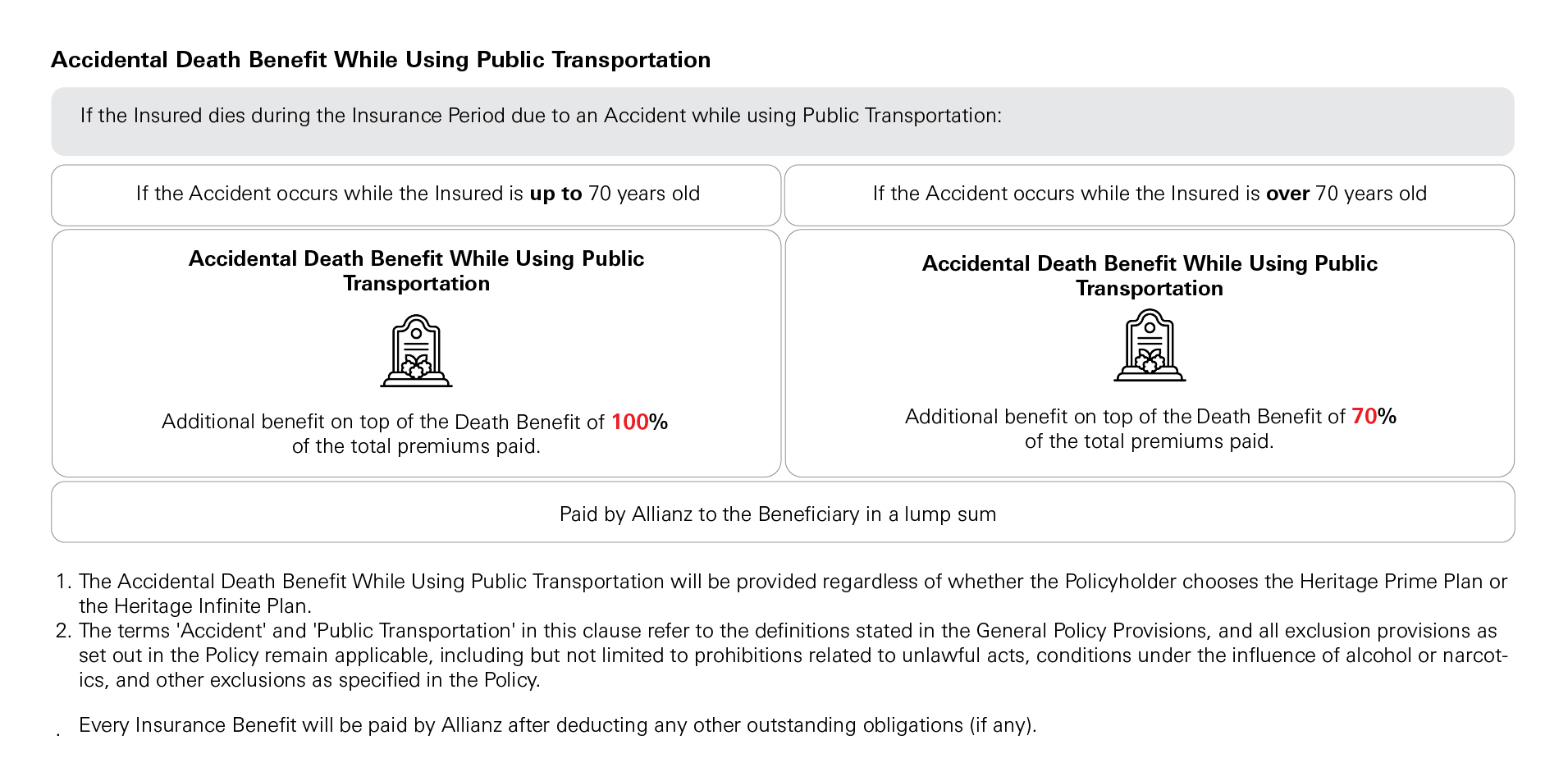

An additional benefit that is available beyond Death Benefit: Accidental Death Benefit While Using Public Transportation(3), which Allianz will pay to the Beneficiary in a lump sum.

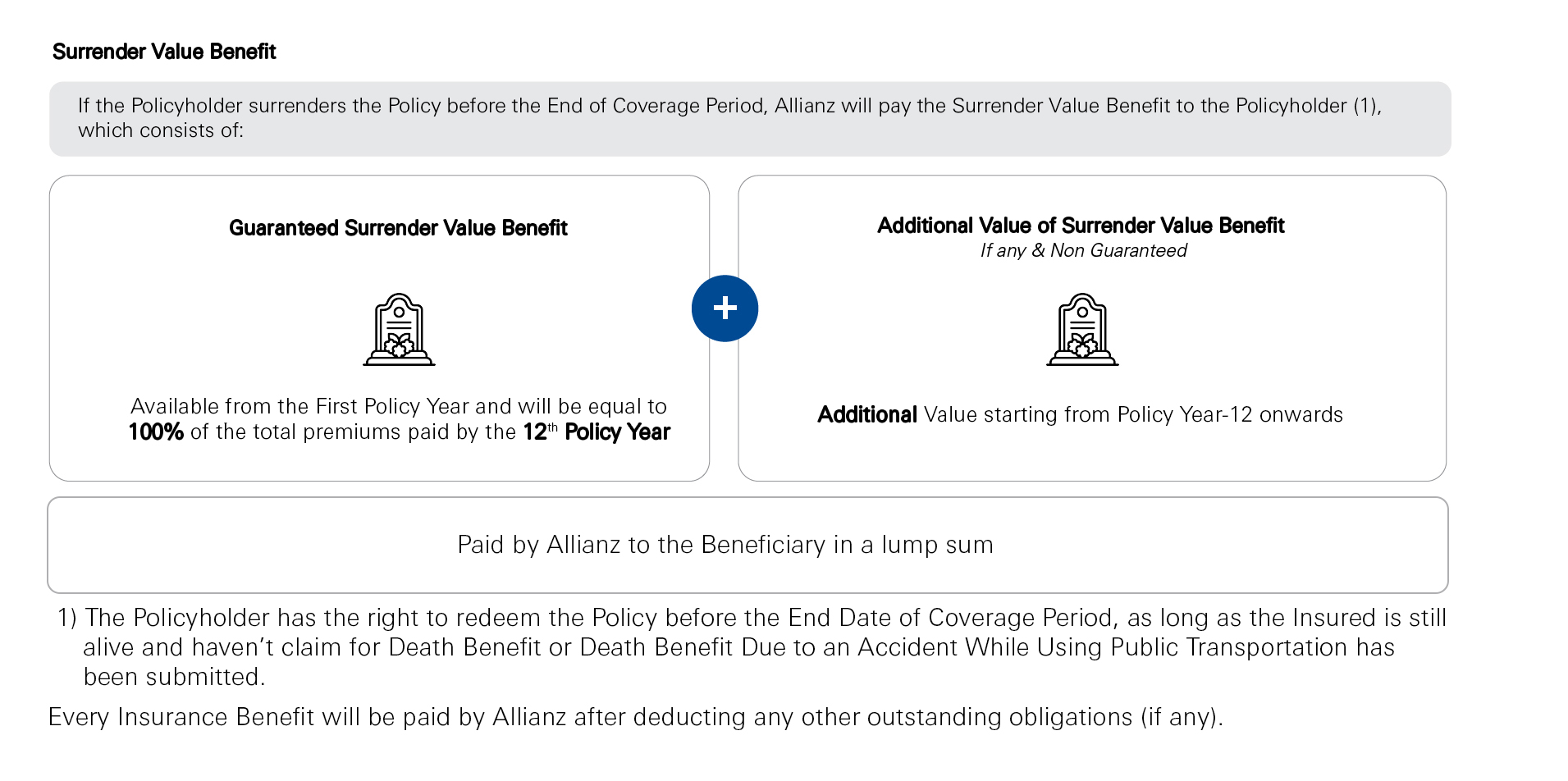

A Surrender Value Benefit if the Policyholder surrenders the Policy before the End of Coverage Date(4).

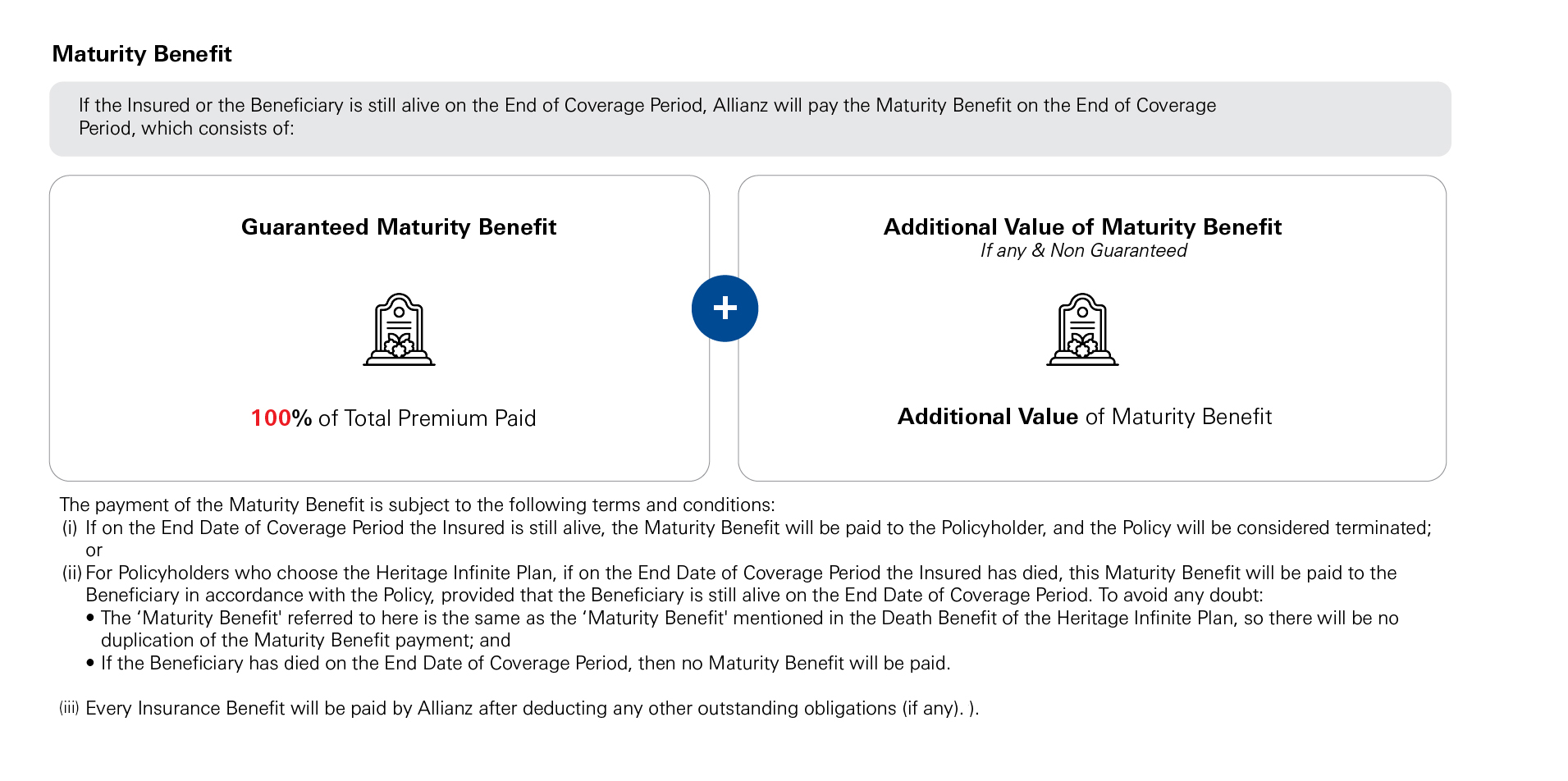

A Maturity Benefit, in which Allianz will pay to the Policyholder or Beneficiary(1) amounting to 100% of the total premiums paid, plus Additional Value (if any).

Maximum protection until the Insured reaches the age of 100, with a Premium Payment Period of 3 years.

Entry age for the Insured starts from 1 month to 70 years old.

-

As applicable in accordance with the provisions of the Policy.

-

The type of Death Benefit program that may be selected by the Policyholder consists of the Heritage Premier Plan and the Heritage Infinite Plan, each with their respective terms, conditions, and benefits as stipulated in the Policy. The selected Plan will be stated in the Policy Data, and if there is any change to the Plan after the Policy is issued, such change will be reflected in an Endorsement issued by Allianz.

-

The terms "Accident" and "Public Transportation" refer to the definitions provided in the Policy, and all exclusion provisions as stated in the Policy shall remain in effect, including but not limited to exclusions related to unlawful acts, conditions under the influence of alcohol or narcotics, and other exclusions as outlined in the Policy.

-

This applies as long as the Life Insured is still alive and no claim has been submitted for the Death Benefit or the Death Benefit due to an Accident while using Public Transportation.

Any Insurance Benefit will be paid by Allianz after deducting any outstanding obligations (if any).

-

Entry Age:

-

Insured: 1 month - 70 years old (nearest birthday).

-

Policyholder: 18 years old - no maximum Age (nearest birthday).

-

-

Insurance Period:

Until the Insured reach the age of 100 years old. -

Premium Payment Period:

3 years. -

Premium payment method:

Regular Premium (Annually, Semi Annually, Quarterly, Monthly). -

Premium:

-

Minimum annual Premium:

IDR 100.000.000/USD 10.000 -

Maximum annual Premium:

Subject to Underwriting. -

Premium amount remains fixed during the Premium Payment Period.

-

No addition or reduction to the Premium is permitted under the Policy.

-

-

Currency:

IDR and USD. -

Underwriting:

Subject to Underwriting Table.-

The underwriting limit referred to is 105% of the total premiums that have been paid.

-

The maximum underwriting limit for a child Insured (up to age 17) is IDR 3,000,000,000 / USD 240,000.

-

-

There are exceptions for Insurance Benefit according with effective terms and conditions in the Policy.