Making Online Banking Safe and Secure

Living in modern era with high technology has made it easy for you to do so many things online, through your cellphone, laptop, or other digital gadget.

There's a lot of convenience in this online connectivity, but the fact that a lot of digital scams/crimes will lurk constantly and it's very important to protect yourself.

At HSBC, we take Online Security very seriously and we want to protect our customers as much as possible. While we have equipped our card security feature system with industry standard

security technologies and practices to ensure that our customers are protected from fraud/crime. However, you also play an important role in protecting your accounts and transactions.

Learn more about the various types of digital fraud/crime so you can avoid any type of fraud. Learn about common scams and precautionary measures you can take to protect yourself online.

Phising, Smishing, Vishing, Sniffing

Be vigilant and do not fall victim to financial scams through Phishing, Smishing and Vishing.

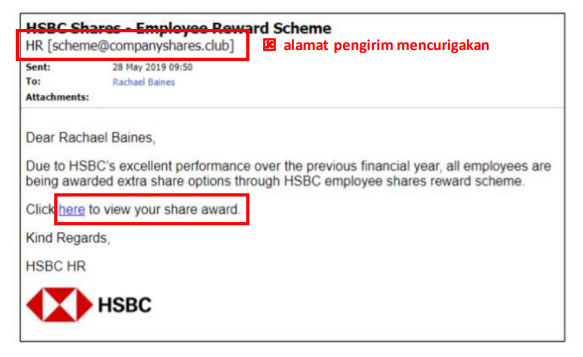

Fraud Email (Phishing)

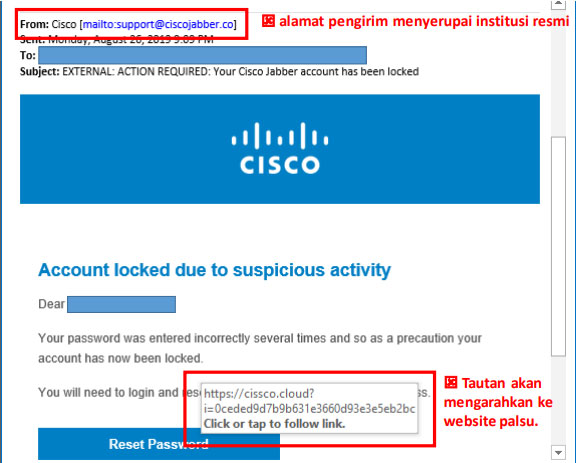

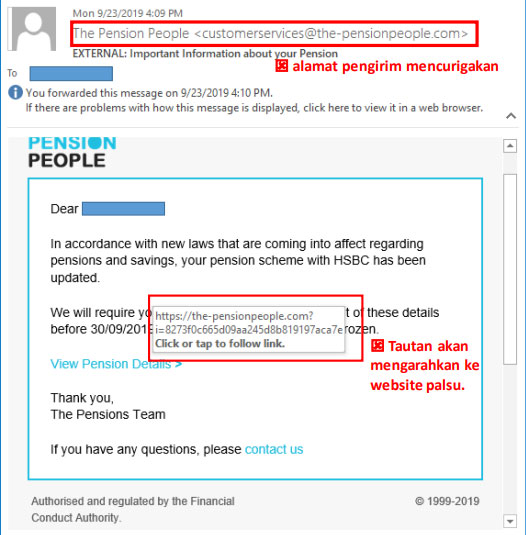

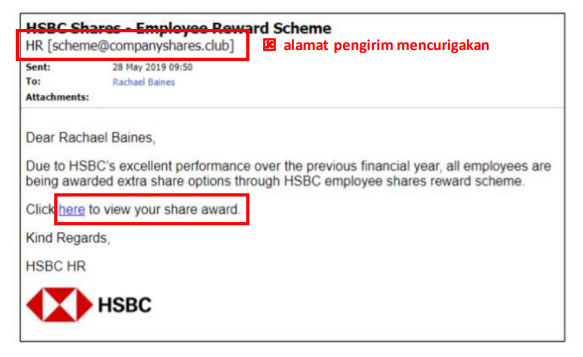

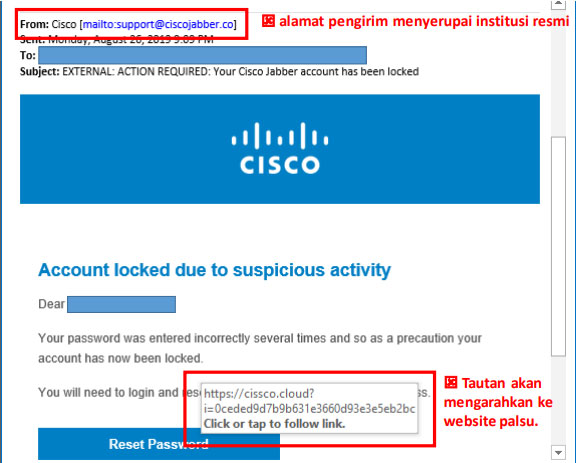

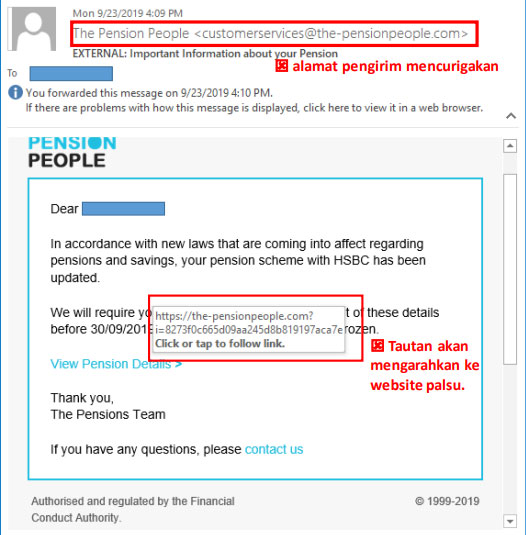

Phishing is an email sent by an irresponsible party to trick us into clicking on a link, opening an attachment, or leaking information we shouldn't have provided

Be wary of unsolicited emails that appear to be from your bank or another trusted organisation (government tax institution) and contain links to websites urging you to provide confidential, personal or financial information. The emails may appear to come from a legitimate source and ttypically, they warn you of an urgent problem with your account and trick you into clicking on a link which takes you to a phony website

If you receive one of these emails, don't reply or click on a link that you're not sure is genuine. Instead, contact the company using a phone number you know is genuine.

Phishing emails typically:

- warn you of some sudden change in an account which means you have to confirm you still use the service

- sometimes have poor spelling and grammar

- ask for confidential or security information such as your online banking details, passwords, account numbers or PINs

- include instructions to reply, complete a form or document attached to the email or click through to a website to verify your account

Fraudulent (phishing) emails may direct you to a bogus or spoof site that's often very convincing. Look closely for these telltale signs:

- The site threatens to shut down your account unless you verify your personal information.

- The site returns an error message and asks you to log in.

- The URL isn't quite right. For example, you see www.hbsc.com or www.hsb.com instead of www.hsbc.co.id.

- The URL may also contain numbers (such as an IP address) or an "@" symbol.

- The padlock icon is out of place. It should be in the browser status bar in the lower right and not within the web page.

- When you double-click on the lock icon, you get a warning that the site address doesn't match the security certificate.

- The logo is distorted or stretched which indicates it's been copied.

- Spelling and grammar mistakes. If there's a phone number on the fake website, it doesn't match the phone number on your account statement.

- You can't link to a home page from the fraudulent site

Other warning signs that an email is fraudulent:

- Generic salutation such as "Dear user" and/or impersonalized information in the text of the email.

- There's an attachment that may launch a virus or spyware on your computer.

- Don't open attachments or click on links if you suspect they may not be genuine.

If you're suspicious of an email claiming to be from HSBC, report to us via HSBC Contact Center to delete it and empty your deleted items.

Fraud SMS (Smishing)

Smishing is sending an SMS that looks like it came from a trusted source with the aim of enticing us to provide personal information such as passwords or credit card numbers.

These may be sent by criminals trying to trick you into giving your personal and financial information (by calling a number or clicking a link).

It's important to remember the following:

- Banks and other organisations such as the police or cellular service providers will never ask you for your full PIN, password or banking codes.

- Fraudsters can mimic text headers so that their messages can join a conversation beneath ones you know are genuine.

If you're unsure whether a text claiming to be from HSBC is genuine, report to us via HSBC Contact Center. Never share your security details with anyone else.

Fraud Telepon (Vishing)

Vishing is a form of crime to illegally gain access to our personal and financial data through telephone conversations using fake telephones, pretending to be from an official institution and requesting our personal data.

Criminals call out of the blue and may claim to be your bank, the police or another trusted organisation like your broadband provider. To make the call seem more convincing they may already have some information on you, such as your account number, address and even some account details. They can also make the call seem authentic by making their phone number look like a number you know and trust. This is known as 'number spoofing'.

The caller will then try to persuade you to get OTP code, CVV number, or PIN to gain access to your financial system whose purpose:

- transfer money to another account for 'safekeeping' or 'holding'

- withdraw cash and hand it over 'for investigation'

- Online transaction

Never give any personal information over the phone unless you are making the call. Be careful of the things below:

- If you receive an OTP SMS that is not from your own transaction followed by a phone call asking you to provide the OTP code with the reason offers banking services, investment/product offers or health services. Do not give your OTP code or banking data to any party for any purpose

- Voicemails asking you to call a number with an international code. You'll end up with an expensive phone bill.

- To claim a lottery prize or other winnings, you're asked to dial a two-digit code preceded or followed by the "#" or "*" key (for example, *79 or 72#). This is a call-forwarding scam.

- Don't be fooled by the dialing numbers that appear on your mobile screen using the official HSBC Call Center numbers (1500700 and 1500800). Remember, HSBC Call Center numbers cannot be used for outgoing calls. Remember that HSBC staff will never ask you for your password

Fraud Online - Sniffing

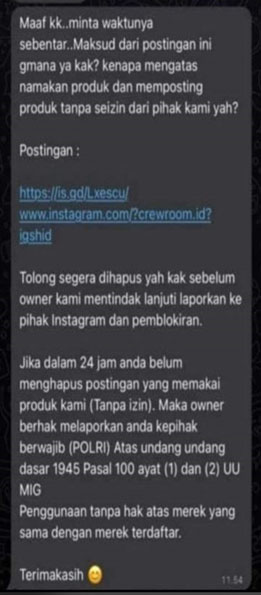

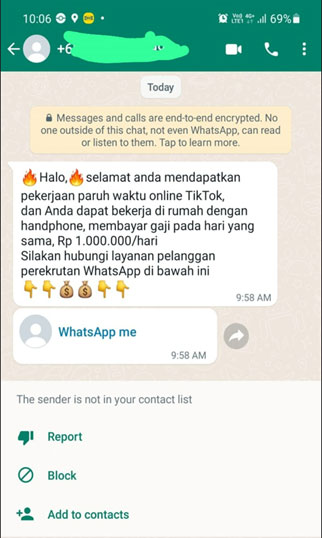

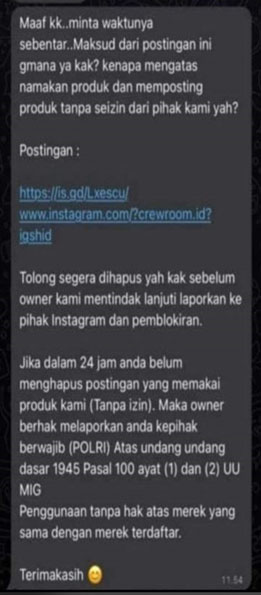

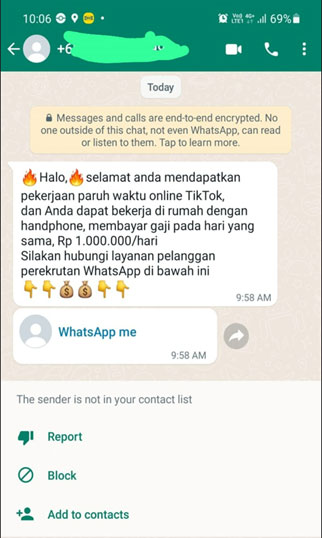

We have all received messages via Whatsapp, SMS and Email which sometimes contain files which are usually interesting and asking us to click or open and install the file sent. Be careful, it could be one mode of online fraud (Sniffing).

Sniffing is a crime of wiretapping by hackers which is carried out using internet network tapping with the main objective of illegally stealing important/sensitive data and information such as m-banking usernames and passwords, credit data information, email passwords and other important data.

Some sniffing practices that are often encountered, such as sending links or APK files to victims. The perpetrator tries to get the victim to open the link or file sent which is actually a fraud, such as receipts from package couriers, PLN bills, wedding invitations, job vacancies, etc.

If the sniffer manages to get into your device then most of the private data on WhatsApp, SMS and email can be accessed. Another potential danger is that important data and information such as usernames, passwords and ATM/Mobile Banking/internet Banking PINs can be identified. Under these conditions, there is the potential for you to experience material losses because the perpetrator can access your banking service account and easily transfer money to his personal account or other account that is intended to accommodate the proceeds of the crime.

How to avoid Sniffing:

- Don't just download applications or click on links sent via WhatsApp, SMS or email from unknown sources

- Check phone number, WhatsApp, SMS and email authenticity. If you don't recognize the number, immediately block it via the block menu provided by the application

- Download applications only from trusted sources such as Google Playstore and App Store

- Activate notifications for various account transactions so that you can monitor all transactions, whether real or suspicious

- Change passwords and PINs in various financial service applications regularly. Use a different password for each of your financial services devices and applications

- Do not use the internet network (wifi) or charge your device in public places especially when making financial transactions

To report phishing websites, smishing texts or suspicious emails which have requested personal banking information contact us via HSBC Contact Center.

If you believe you have shared your confidential information either online, by telephone or any other means call us immediately using the telephone number on the back of your card.

You need to know that scammers work by gaining someone's trust and getting them to disclose information that should be kept secure.

Scammers usually contact people by phone (vishing), text (smishing) or email (phishing). They'll claim to be someone in a position of trust, such as bank staff, representatives of telecoms or utility companies, or even the police. Having gained the person's trust, they'll then ask for sensitive information or things which will enable them access to the person's bank accounts.

Please be reminded that the bank would never ask for data, such as:

- Your 6-digit PIN

- online banking codes like your secure key or password

- OTP code

- mengambil kartu kredit atau debit, buku cek atau uang tunai Anda.

Your bank would also never ask to:

- collect your credit or debit cards, cheque books or cash.

- transfer funds to a different account for 'safekeeping'

Please be careful with scams on behalf of HSBC. All losses arising from your negligence will be your full responsibility.

Phising Sample

Sniffing Sample

SIM Swap

Protect Yourself from Mobile Phone Number Take Over (SIM Swap).

SIM Swap is mobile phone SIM card replacement that is done illegally through cellular operator by fraudster, in order to get access to your banking transaction such as receiving OTP (One-Time Password) for online transaction that you have not done.

Below are Tips to Avoid SIM Swap:

- Immediately contact your cellular operator when mobile phone is stop functioning, such as unable to make / receive call or SMS.

- Immediately contact HSBC Phone Banking at 1500 700 (Premier), 1500 808 (Signature & Platinum), 64722 from mobile phone (Other HSBC Credit Card) if finding indication / receiving information that you are victim of SIM Swap.

- Not publishing mobile phone number at social media or using different mobile phone number for your banking activity.

- Be cautious when you share personal data (date of birth, mobile phone number) to other party, and when use your credit card information (card number, valid period, CVV/CVC number - 3 digits number at the back of the card).

Fraud OTP

What if your personal data and OTP are known to others?

Be Alert! Take good care of your personal data and OTP to avoid account break-ins or fraud from irresponsible parties.

How do they work?

- Criminals will contact you and impersonate bank staff to get OTP code

- Criminals can use the same service number as the bank's official service.

How to avoid it?

- Don't panic if you receive an SMS OTP code from an unknown number

- Do not be provoked when contacted by people who claim to be bank staff and tell you that there are transactions that you did not make, all of which are aimed at getting your OTP code/personal data

- Get to know the official HSBC Call Center number (1500 808 / 1500 700), this number is only used to receive calls and is NOT used to make outgoing calls.

- Don't respond to messages from strangers

- Keep your email and contact numbers up to date to protect you from financial losses due to data theft.

Always keep your personal data and OTP code confidential. Any losses due to your negligence are not the responsibility of HSBC.

Mobile Malware

Protect Your Personal and Account Data from Mobile Malware

Mobile Malware or Mobile Malicious Software is a software designed to bring harm to your mobile devices such as smartphone or tablet to damage its operating system or application and or stealing your personal and banking data. How Malware works: The spread of malware is usually through an internet connection, such as sending short SMS/email messages, uploading files or installing software.

Prevention action from Malware:

- Choose a safe place if you want to download/install apps and beware of installing apps with excessive requests for permission to access your personal device.

- Avoid opening suspicious sites. Be careful that you are not directed to download a fake antivirus application.

- Avoid clicking on online ads (adware) that appear suddenly, especially from links you don't recognize.

- Don't open unknown or suspicious attachments in emails especially from senders you don't know.

- Do not plug your USB stick into any computer.

- Do not use public wifi networks for bank transactions.

- Do not save your online banking login details on public computers. Change your password periodically.

- Install antivirus on your device. Antivirus can help protect your device from virus and malware attacks.

- Inform the bank every time your personal data changes.

Protect yourself from Financial Crime

There are several things you can do to keep your personal data and accounts safe from financial crimes. Learn about common crimes and precautions you can take to protect yourself

Banking Transaction

Things to remember when conducting banking transaction:

- Do not sign blank form(s). Please ensure you have understood every field to be completed prior to signing any transaction form.

- For investment and insurance transaction, please ensure you have been explained about the product feature (including product risk) of the product offered.

- Please ensure you have acknowledged and understood the terms and conditions applied to any banking product and service offered.

When using an ATM:

- Cover the keypad when you enter your PIN. Do not disclose your PIN to anyone including the Bank / Contact Centre.

- Be cautious and report to HSBC if you observe any suspicious devices (e.g. pin hole camera).

- Reject any offers of assistance from strangers when you are performing ATM transactions.

- If you encounter any difficulties when using the ATM, cancel your transaction and inform HSBC.

- Please be alert when you encounter retained card problem in ATM machine, if you suspect fraud and card counterfeit, please report to HSBC 24 hours Phone Banking Services or nearest branch to block & replace the card.

- Do not use the ATM if you spot any sticker on the ATM machine requesting you to contact a phone number other than the HSBC Contact Centre i.e. Premier service : 1500 700 / 62-21) 2551 4722 (from overseas), Advance/Platinum/Signature service : 1500 808 / (62-21) 2552 6603 (from overseas).

Cards Transaction

Tips when using Card (Debit or Credit Card)

- Do not let your Debit/Credit Card out of sight when using it to make transactions.

- Make sure your Card is returned after every transaction.

- Keep your transaction receipts in a safe place, or destroy them.

- Do not share your Card number over the phone, unless you make a transaction with a trusted company.

- Avoid entering card number information when using public computers, such as internet cafes, or when using at unsafe places.

Protect Your Card:

- Your card is like cash. Never leave your card or lend your card to anyone.

- Bring only the necessary cards.

- List your card numbers and phone numbers that you can use to report card loss or theft. Keep the list in a safe place; away from the cards.

- Check the validity of your card. If a replacement card has not been received at least one week before your card expires, contact your bank to inquire about the reason.

- Be careful with your surroundings area before, during and after you make card transactions. If there are things that are suspicious or out of the ordinary, we urge you to be careful in conducting transactions in that environment and if necessary contact the authorities.

- Please re-check your card and proof of your transaction after you make the transaction.

- HSBC has never authorized any party to come and retrieve your Debit or Credit Card for any reason. Please be careful with scams on behalf of HSBC.

- If your card is lost, immediately contact HSBC Phone Banking at 1500 700 (accessible from all cities in Indonesia) and (6221) 2551 4722 (accessible from overseas) for HSBC Premier customers or 1500 808 (accessible from all cities in Indonesia) and (6221) 2552 6603 (accessible from overseas) for HSBC Advance.

Credit Card Skimming

Beware of Credit Card Skimming

Credit card skimming is illegal act to replicate data from credit card magnetic stripe. Skimming could occur anywhere you do transaction including restaurants, gas stations and other retail locations. Please be aware and avoid these:

- Merchant process your credit card twice, once dipping your credit card into EDC machine for your purchase and a second time through a skimming device (as general rule, don't let your card out of your sight). If you spot your credit card is processed inappropriately, please call HSBC Phone Banking Services immediately.

- Someone looking over your shoulder at the register to spot your credit card PIN. Please protect your PIN.

- Your HSBC Credit Card has already embedded with Chip to make your personal data safer and very hard to replicate. Please ensure that your card is dipped into EDC machine and not swiped. For your overseas transaction, not every EDC machine equipped with Chip Reader, please ensure your credit card only swiped for your purchase.

Learn more about various banking information and tips to avoid fraud

How can you avoid being scammed? Here is general information you need to know to avoid being scammed

Investment Offering

Be aware that currently there are many cybercrime modus occurring. The target of criminals is to gain access to your personal/banking data. Beware of data theft under the guise of offering banking or investment products.

In practice they use social media communication tools by using a name similar to an Investment Manager company. They spread scams through websites/online accounts and usually offer high-yield investments. If you do not have an adequate understanding of investment offer and are tempted by high yields, you may become a victim of this kind of fraud.

Below are tips to avoid this scam:

- Do not be tempted by the lure of buying high-yield sharing products/investments that are offered by someone claiming to be from a bank or investment manager.

- If you get a product offering/investment message, and are interested in the product being offered, make sure that you recognize the sender of the message (SMS / chat account / social media account), or you need to ensure that the message was sent by a trusted source.

- Do not click/open any links or attachments to e-mail, SMS /WA messages or other applications that you may receive from dubious or unknown sources.

- Currently HSBC DOES NOT have an official Telegram account and does not have a group with any applications to offer investment offers. If you find or are invited to a group like this, you can click report it by clicking Report (fake account) on the application

- Never share your personal/banking data such as: your name, bank, account number, mobile phone number, email address, correspondence and occupation to anyone, even if the person pretend to be an Investment Manager, a representative of a Bank/other institution.

- Immediately report to the Bank if you have experienced with fraud to immediately block the account.

- If you find an investment offer that is not licensed, illogical, and is fraudulent, you can also contact OJK or the OJK Investment Alert Task Force on telephone number 157 or WhatsApp to number 0811 157 157.

- If currently known the name of PT. Bank HSBC Investasi as one of the investment managers, please be advised that PT. Bank HSBC Investasi is not part of PT. Bank HSBC Indonesia and PT. Bank HSBC Indonesia is not affiliated with PT. Bank HSBC Investasi. Any things and products offered by PT. Bank HSBC Investasi is not the responsibility of PT. Bank HSBC Indonesia.

To get more info about financial products available at PT Bank HSBC Indonesia along with their features, please visit the nearest HSBC branch office, contact our Call Center, or visit our official website www.hsbc.co.id

HSBC Social Media Account

WhatsApp Account

Never give any personal information and debit/credit card data such as card numbers, CVV, PIN numbers, expiry card information or OTP codes to parties on behalf of PT. Bank HSBC Indonesia, especially using WhatsApp application. Currently, PT. Bank HSBC Indonesia does not yet have an official WhatsApp account.

To prevent this, you can then provide a "report" to WhatsApp on the account by clicking the "Report business" button on the account's profile.

Social Media Account

The official Twitter account of PT. Bank HSBC Indonesia is @HSBC_ID (www.twitter.com/hsbc_id) and the official Facebook account of PT. Bank HSBC Indonesia is Facebook Fan Page HSBC Indonesia (www.facebook.com/HSBCIndonesia).

Never share any personal data and debit/credit card information such as card numbers, CVV, PIN numbers, card expiry date information or OTP code to anyone, including those on behalf of PT. Bank HSBC Indonesia.

Always use the Bank's official communication channels (HSBC email and HSBC telephone) to convey your banking needs, for security reasons avoid submitting personal data through

Customer Data Update

Ensure your personal information update

Inform the Bank for every changes on your (or your attorney's) personal data together with the relevant supporting document(s). Such data includes but not limited to the following:

Personal Customer1

- Full name

- Job title or line of business.

- Residential Address / Office Address.

- Email address.

- Home / Office / Mobile Phone Number

- ID (KTP/passport/staying permit) number and expiry date.

- NPWP number (mandatory for existing/prospective securities account holder).

- Type of transaction(s) which will be frequently performed.

- Purpose of account opening.

- Nationality.

- Marital status.

- Source of fund and income.

Corporate Customer2

- Business License (nature of business activities).

- Articles of Association (including subsequent amendment if any).

- Address and contact details.

- Source of fund and purpose of account opening.

- Taxpayer Registration Number (NPWP).

- Composition of Board of Directors and Commissioners (along with their ID Card: KTP/passport/staying permit).

- Company's shareholding structure up to the ultimate beneficial owne2

Remark:

1 The requirement of customer data update is referring to regulation from the Financial Services Authority No.12 / POJK.01 / 2017 concerning Implementing the Anti-Money Laundering and Prevention of Terrorism Financing Programs in the Financial Services Sector.Return to main text

2 Any individual who owns minimum 10% shares in your company, directly and/or indirectly.

PIN

Tips to safeguard your PIN (apply for Debit/ATM Card, Credit Card and Pin Phone Bnaking)

- Never disclose your PIN to anyone, not even someone claiming to be from the bank or the police.

- Immediately change your PIN after you receive it from HSBC.

- Change your PIN regularly.

- Memorize your PIN and do not write it down

- Ensure that no one is looking whenever you are keying-in your PIN.

- Select PINs that cannot easily be guessed by anyone, don't use ones that can be easily guessed such as date of birth, phone number, etc.

- Use different PINs for different channels (e.g. Internet Banking, ATM and Phone Banking).

Remember:

- Phone PIN verification is not required for general inquiries.

- Phone PIN verification is only required for transactions or other requests. The customer must enter the telephone PIN directly into the voice response system

Internet Banking

Keep your computer secure.

- Make sure you have the latest security updates and patches.

To check for patches and updates you should visit the publisher's website, typically in their Download section.

Microsoft users can visit: http://windowsupdate.microsoft.com http://windowsupdate.microsoft.com which can automatically check what is required, and then suggest that you download it.

- Use and regularly update anti-virus software.

There are many effective programs to choose from, but the most common commercial products are from McAfee, Symantec (Norton) and Sophos.

It is also possible to obtain free anti-virus protection. A search for "free anti-virus" on Google will provide a list of the most popular.

Always update your anti-virus software with the latest "virus definition" files. If you are unsure how to do this, you should refer to the program's own Help function.

- Use personal firewalls.

Firewall is another small program that helps protect your computer and its contents from outsiders on the Internet. When properly installed, it stops unauthorized traffic to and from your PC.

There are many effective programs to choose from. Common commercial examples are from Zone Alarm, Symantec (Norton), McAfee and Computer Associates.

- Use an anti-spyware program.

Spyware is often loaded onto a PC as part of a free download of another service.

Spyware is not the same as a virus in that it only records what you do rather than altering how your machine works. Because of this, anti-virus software is not effective in identifying and removing spyware, you will need to download and run a specialized anti-spyware program.

Anti-spyware security software currently available include McAfee, Spybot Search and Destroy, AdAware, Spyware Eliminator, Spyware Doctor and Microsoft anti-spyware. We strongly recommend that you install and use a reputable anti-spyware product to protect yourself against spyware on your PC.

- Don't share computers

Disable your computer's "File and Printer Sharing" capabilities to help prevent unauthorized access. Use your computer's Help function for instructions.

- Filename extensions

Most operating systems use filename extensions. For example, a word document ends with .doc and a photo image may end with .jpg

By default some operating systems do not show these extensions. Whilst this presents cleaner looking file names, it also provides viruses with a means to hide. Use your computer's Help function (Index and then "display") for steps needed to display file extensions. Any file with what appears to be a double extension - e.g. wow.jpg.pif is almost certainly a virus and should never be opened.

How to register for HSBC Internet Banking?

Visit the following link for a guide on how to register for HSBC Internet Banking:

https://www.hsbc.co.id/1/2/id/personal/layanan-express-banking/internet-banking/overview#getstarted

Keep your Internet Banking session secure

- Logging in

Ensure you enter your correct password(s) without the details being inadvertently disclosed to someone who may be looking over your shoulder

- Logging off

Always remember to log off from the Internet Banking session and close your browser when you have finished your online banking. This will clear all traces of your visit from the PC's memory.

Tips on how to keep your internet banking password secure.

- Memorize the keys to your access and avoid writing down your password number. Your Internet Banking ID and password are your keys to accessing our online services. Only the right combination of these allows you access.

- Avoid using numbers that are easy for others to guess as your password number such as date of birth, phone number, etc.

- Do not share your password with other people, including someone claiming to be from the bank or the authorities.

- Change your password regularly

- Make sure no one sees you enter your password number.

- Do not use links to access our site

- Always type a web address or use Favorites. Do not use links because they can lead to fake websites with the same appearance as ours.

- Avoid using public computers for Internet Banking transactions.

- As much as possible avoid using a PC in public, such as in an internet cafe to access Internet Banking.

Security Token

What is the Security Token?

The Security Device is a small, digital authentication device that generates a an ever changing, single-use six digit Security Code for performing certain activities and transactions such as 3rd party transfers from within your HSBC Internet Banking account. When you activate your Security Device it becomes unique only to you and no other Security Device can be used to generate one time security codes for your transactions.

How to get Security Token?

Please click the following link to find out how to get your Security Token

https://www.hsbc.co.id/1/2/misc/pib-learning-center/order-security-device

Why do I need an Online Security Token?

We made the decision to introduce the Online Security Token technology, in addition to username and password requirements, to offer the best protection available against any potential threat of identity theft and cybercrime. The Online Security Token will generate a Security Code which is required each and every time you would like to perform certain transactions such as when moving funds from out of your account to a third party. The Online Security Token provides an enhanced level of security for these kinds of transactions as it will require a 2-step authentication process for it to go ahead which User ID+Password and unique code generated by Security Token itself.

How do I use the Online Security Token?

In some online transactions that require higher security protection, you will be asked to enter a security code from your Security Token. Just click the button on the Security Token, a 6 digit security code will be displayed for you.

To request a replacement Security Token, please contact our Call center service hotline at 1500 808 (Advance) or 1500 707 (Premier) or, you can visit us at one of our branches.

For complete information about HSBC Security Token, please click the link https://www.hsbc.co.id/1/2/id/personal/layanan-express-banking/internet-banking/overview#faq

Email

Keep your email secure.

In general, emails sent or received via regular email addresses (example: yourname@hotmail.com) have no protection for their content. Therefore, there is a risk that the personal data you send via email may be accessed by unauthorized parties. Never send your personal data or banking data such as your password/USER ID and/or password via email to anyone.

Top Tips

- Do not send sensitive information via email.

- Do not answer unknown email messages that ask for personal information.

- Be careful when opening unknown email messages that have attachments. Do not open email attachments that contain documents that end in .exe, .pif, .vbs because they usually contain viruses.

- The spread of the virus is usually done via email. Some viruses can send duplicates to everyone in the address book who has been exposed to the virus. This means that the email containing the virus could be from someone you know.

- Any document that has a double extension is almost certainly a virus and should be deleted. Use the Help function on your computer for further instructions.

The spread of the virus is usually done via email. Some viruses can send duplicates to everyone in the address book who has been exposed to the virus. This means that the email containing the virus could be from someone you know. Do not open email attachments that contain documents that end in .exe, .pif, .vbs because they usually contain viruses.

Statements

The Bank sends the account statement every month according to the printed date that has been determined by the Bank. Immediately report to the Bank if you do not receive your bank account statement for checking. Check your account transactions frequently via internet banking. Avoid sending monthly account statements by mail, instead use e-statements.

We recommend that you check your account as often as possible, because:

- More than 50 percent of frauds are first identified by victims.

- If fraud is detected more quickly, the impact on your finances will be less.

- Customers who access accounts online can detect criminal acts faster than customers who depend on account statements sent by mail.

- It is possible that the billed transaction amount differs from the actual transaction amount. For this reason, it is recommended that you verify and match your proof of transaction with your monthly statement bill. Report unauthorized transactions immediately. After you reconcile your monthly bill, destroy all evidence and dispose of it in a safe place to avoid misuse of the account statement by irresponsible people.

One Time Password (OTP)

HSBC Credit Card offers you even more protection when shopping online. With 3D Secure Authentication, which provides additional authentication through One-Time Password (OTP). The OTP will be sent to your mobile phone each time you do an online transaction at secure merchant (participating merchant in 3 Domain Secure / 3D Secure).

One-Time Password (OTP) for your online purchases

You are required to key in an One-Time Password (OTP) whenever you make an online purchase at participating 3 Domain Secure (3D Secure) merchants using your HSBC Credit Card. A pop-up screen will appear, prompting you to key in the One-Time Password (OTP) which will be sent to your mobile phone number registered in our system.

What is One Time Password (OTP)?

One Time Password (OTP) is a randomly generated six digit password sent via SMS to your mobile device, which provides a stronger method for authenticating your online transactions you feel comfortable when shoping online.

What is 3D Secure?

3D Secure is a security protocol used by banks worldwide to authenticate online credit card transactions. You can recognize 3D Secure merchants by the "Verified by Visa" or "MasterCard SecureCode" logos on the online merchant's website.

For more info click here. disini.

1 The success of OTP SMS delivery depends on the availability of the network of telecom operators.Return to main text